Business Risks

In order to appropriately manage risks that may affect the Group's business to stably increase corporate value, the Group has established relevant regulations and a risk management system and continuously monitors and controls risks.

(1) Risk Management System

In promoting risk management, in accordance with its "Risk Management Regulations," the Company has designated the President as the "Chief Risk Management Officer" and has established a "Risk Management Committee" chaired by the President & Chief Executive Officer to oversee risk management for the Group.

The Risk Management Committee formulates annual risk management plans, evaluates and analyzes risks that are important to the Group's management (priority risks to be addressed), formulates preventive measures and countermeasures, and periodically monitors the status of countermeasures while regularly presenting agenda items for deliberation and submitting reports to the Board of Directors.

Regarding risks other than priority risks to be addressed (department and division management risks), the general managers of offices and branches, who are "risk management officers" as stipulated in the Risk Management Regulations, and each committee, serve as a risk response organization (risk owner) to appropriately prevent and manage said risks.

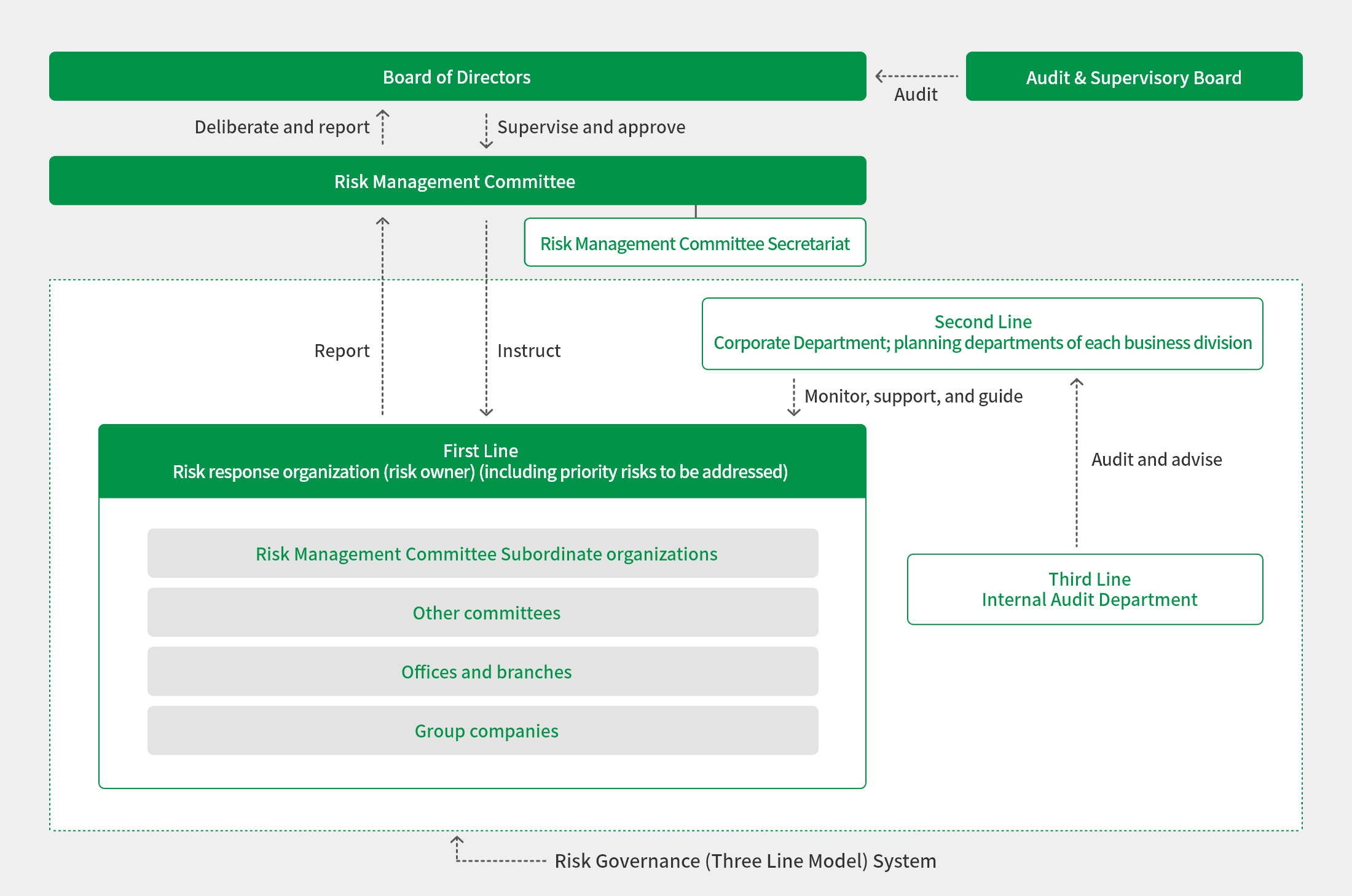

Furthermore, in order to maintain and improve the effectiveness of risk management activities, a risk governance (Three Line Model) system has been established in which the Corporate Department and planning departments of each business division (Second Line) monitor, support, and provide instructive guidance to offices and branches (First Line) with respect to risk management, and the Internal Audit Department (Third Line) audits and advises them in terms of their response to risk management at offices and branches.

Risk Management Structure Diagram

(2) Business Risk and Other

Risk is defined by the Group as "any factor of uncertainty arising in the course of business operation within the Group." Risk assessments are conducted on risks in the Group from the perspectives of impact (financial loss, human loss, etc.), likelihood of occurrence, changes in business environment and corporate values. Henceforth the Risk Management Committee has established a process for identifying "priority risks to be addressed" that are to be monitored directly by the committee.

The main risks that could affect the Group's business performance and financial position, including the priority risks to be addressed, are listed below. Furthermore, the risks indicated below do not cover all the risks associated with the Group, as there are other risks that may influence the judgment of investors.

Forward-looking statements in the document are the judgment of the Group based on information available as of the end of the fiscal year under review.

(i) Risks related to real estate development

The Group promotes its business after grasping and analyzing assumed risks in the real estate development business mainly in the Group Management Meeting and taking countermeasures beforehand. However, when a delay in business schedule or increase in costs, etc. occurs due to bad weather, natural disasters, delay in approval and permission, soil contamination or buried objects being found, or other unforeseen events, the Group's operating results, financial position, etc. may be impacted.

(ii) Risks related to price fluctuations

The Group constantly monitors and analyzes the cost trends in each business, paying close attention to the impact on profitability. However, if there is a significant and rapid fluctuation in prices and the increase in costs cannot necessarily be reflected in rents or sales prices, the Group's operating results, financial position, etc. may be impacted.

(iii) Risks related to trends in the real estate market

While the Group constantly monitors and analyzes domestic and international economic trends and real estate market conditions and closely monitors the impact on its operations, the Group's operating results and financial position may be affected by rapid or drastic fluctuations in economic conditions or market conditions resulting in a decline in office needs due to deteriorating corporate performance in the rental office market, a decline in customers' willingness to purchase condominiums in the condominium market, or a decline in investment demand in the real estate investment market.

(iv) Risks related to interest rate fluctuations

The Group has conducted stable fund procurement centering on interest-bearing debt in the form of long-term borrowings and has fixed interest rates for almost all long-term borrowings to minimize the impact of interest rate fluctuation. However, when interest rates rise, the Group's operating results as well as its financial position, etc. may be impacted and the value of assets owned by the Group may decrease.

(v) Risks related to owned shares

The Group holds marketable shares in other companies that are deemed to help increase corporate value in the medium to long term through maintaining and strengthening business relationships as those for other purposes than pure investment (strategic shareholdings). Individual strategic shares are appropriately managed toward their reduction based on the "Corporate Governance Code (Principle 1-4)" by reporting their actual transactions and others periodically to the Board of Directors and assessing whether continuing to hold them is appropriate. However, when the market price of shares falls and the value of owned shares falls significantly, for instance, the Group's operating results, financial position, etc. may be impacted.

(vi) Risks related to environmental issues and climate change

The Group believes that the intensification of policies and regulations related to climate change, as well as the increased frequency and severity of extreme weather events, could potentially impact the Group's business operations. Through discussions at the Sustainability Committee chaired by the Company's President & Chief Executive Officer, the Company has endorsed the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and has conducted scenario analysis in accordance with the recommendations of the TCFD to identify climate change risks and opportunities, evaluate their materiality, and examine their impact on the Group's business profit. Following this, we have set targets related to the promotion of a decarbonized society - one of our identified materialities - and we are engaged in efforts to achieve these targets. However, should there be further intensification of policies and regulations due to climate change in the future, the Group's operating results, financial position, etc. may be impacted.

(vii) Risks related to natural disasters, man-made disasters

The Group takes business continuity measures in cases of emergency, such as establishment of various regulations and manuals as well as implementation of periodic training in preparation for earthquakes, rainstorms, flooding and other natural disasters as well as wars, riots, terrorism and other man-made disasters. However, when natural or man-made disasters or such occur, business activities may be impacted as employees may suffer damage and the value of assets owned, managed or operated by the Group may decrease. Accordingly, the Group's operating results, financial position, etc. may be impacted.

(viii) Risks related to information leakage and security

The Group handles an enormous amount of personal and other confidential information in various businesses. Thus, the Group appropriately manages information by establishing informational management rules and information system management rules as well as by reinforcing systems to manage documents, data, etc. It further makes specific efforts, including enhancing security for information devices on both tangible and intangible fronts and conducting training to prepare for a potential information security risk while obtaining cyber insurance as needed. However, when information leakage outside the Group occurs due to cyberattacks, negligence of the Group's officers and employees, etc., the loss of social credibility of the Group, occurrence of compensation for damage, etc. may impact the Group's operating results, financial position, etc.

(ix) Risks related to legal compliance

The Group conducts business activities under legal regulations including the Companies Act, the Financial Instruments and Exchange Act, the Labor Standards Act, the Real Estate Brokerage Act and the Building Standards Act. The Group has further established a legal compliance structure based on the "Compliance Charter" and the "Compliance Rules" and provides education such as periodic training to the Group and its officers and employees. However, if the Group and its officers and employees violate laws, regulations, etc., the loss of social credibility of the Group, imposition of fines and penalties, etc. may impact the Group's operating results, financial position, etc.

(x) Risks related to establishment and revision of legislation, taxation systems, and government policies

The Group's businesses are affected by regulations including ordinances, tax systems, etc. set forth by local governments as well as by laws and regulations. Accordingly, the Group promotes business after collecting information from relevant authorities, industry groups, professionals, etc. in a timely manner and takes appropriate measures. However, when relevant laws and regulations, ordinances, tax systems, etc. are established, revised, etc. in the future, this may impact the Group's operating results, financial position, etc. due to the newly arising obligations, increase in cost burden, restriction on rights, etc., possibly leading to a decrease in the value of assets owned by the Group. Furthermore, when a difference arises in views of tax reporting with tax authorities, the Group's operating results, financial position, etc. may be impacted.

(xi) Country risk related to the Group's overseas operations

The Group operates in countries including the United States, Australia, Thailand, and China based on "Expansion of overseas business," which is one of the key strategies spelled out in the Group's Medium-Term Business Plan. In conducting business overseas, it strives to collect necessary and appropriate information through partnerships with local entities that are well-versed in the political or economic climate and laws and regulations in the respective countries or regions where it operates. However, if a project is halted, a schedule is delayed or costs increase due to the deterioration of political or economic conditions, any change of laws and regulations, and worsening security, to name but a few, in the countries where we operate, it may impact the Group's operating results, financial position, etc.

(xii) Risks related to infectious diseases

If the economy stagnates or deteriorates in Japan due to factors such as the re-spread of COVID-19 infections or the outbreak of influenza, the Group's operating results, financial position, etc. may be impacted. The same concern is shared with foreign countries in which the Group develops oversea businesses (the United States, Australia, Thailand, and China, etc.); if the economy slows down or weakens, it could impact the Group's operating results, financial position, etc.